Prior to launching any PPC campaign, you must benchmark your competitors. This vital step will help you identify strategic best practices and set your account apart – which can improve performance dramatically.

On a more tactical level, benchmarking allows you to:

- Gather audience insights to better allocate budget.

- Assess ad quality and relevance to spark higher creativity levels.

- Identify ideal customer journeys that will improve conversion rates.

- Find common ground for comparison instead of using results from generic studies.

In this article, I will explore how to benchmark PPC competitors using accurate and reliable data sources.

1. Identify your PPC competitors

While in-house marketers know direct competitors and distributors by heart, online competitors may vary from real-life competitors. In practice, this means that you can identify other competitors as follows:

- Direct competitors: They offer nearly identical products or services. They are your most obvious competitors.

- Indirect competitors: They do not offer the same products or services but target the same audience. Think sleeping app vs. mattresses. Depending on the audience, they can be harmful or a mild nuisance.

- Distributors, affiliates and comparison sites: They promote your products and your competitors’. Half competitors, half partners: you should not ignore them.

Google Ads Auction Insights report

To identify indirect competitors, I recommend you start by using Google Ads Auction Insights report. It is reliable and free (as long as you run a Search/Shopping campaign).

Select a keyword (preferably exact or phrase match type) and note competitors with high Impression Shares.

In the below table, you’ll find an example for mattresses. Notice direct, indirect and distributor competitors:

Legend:

– Direct competitors

– Direct competitors – Indirect competitors:

– Indirect competitors: – Distributors, affiliates, comparison sites

– Distributors, affiliates, comparison sites

As you can see, there is quite a lot of pressure from distributors, so you may want to review your strategy based on your unit economics.

Does it even make sense to advertise on such a keyword? Or is the share of revenue given to distributors so high you’d rather compete with them for that click?

On the other hand, there’s only one indirect competitor. While it’s not obvious if their audiences are qualified (they “only” sell bed linen), you could still experiment and potentially find untapped audiences.

Organic results

While you want to focus on PPC competitors, you can always learn interesting bits and pieces from competitors who do not face you in terms of PPC results. So, I recommend you scan Google’s top organic results for the same keyword.

To do so, you can either Google that directly or use a dedicated tool such as Ahrefs or Semrush.

At this step, your goal is to:

- List competitors with the most prominent reach: do they have high traffic for that keyword?

- List themes (SERP copy) that don’t get much traffic.

With those two groups of competitors (and already a bunch of useful information), you can move on to the next phase: stealing their best ideas.

2. Competitors’ PPC ad analysis

While there are plenty of PPC spying tools out there (SpyFu being the most popular I believe), I recommend using 100% reliable data sources: the ad networks’ ads libraries.

Ad libraries

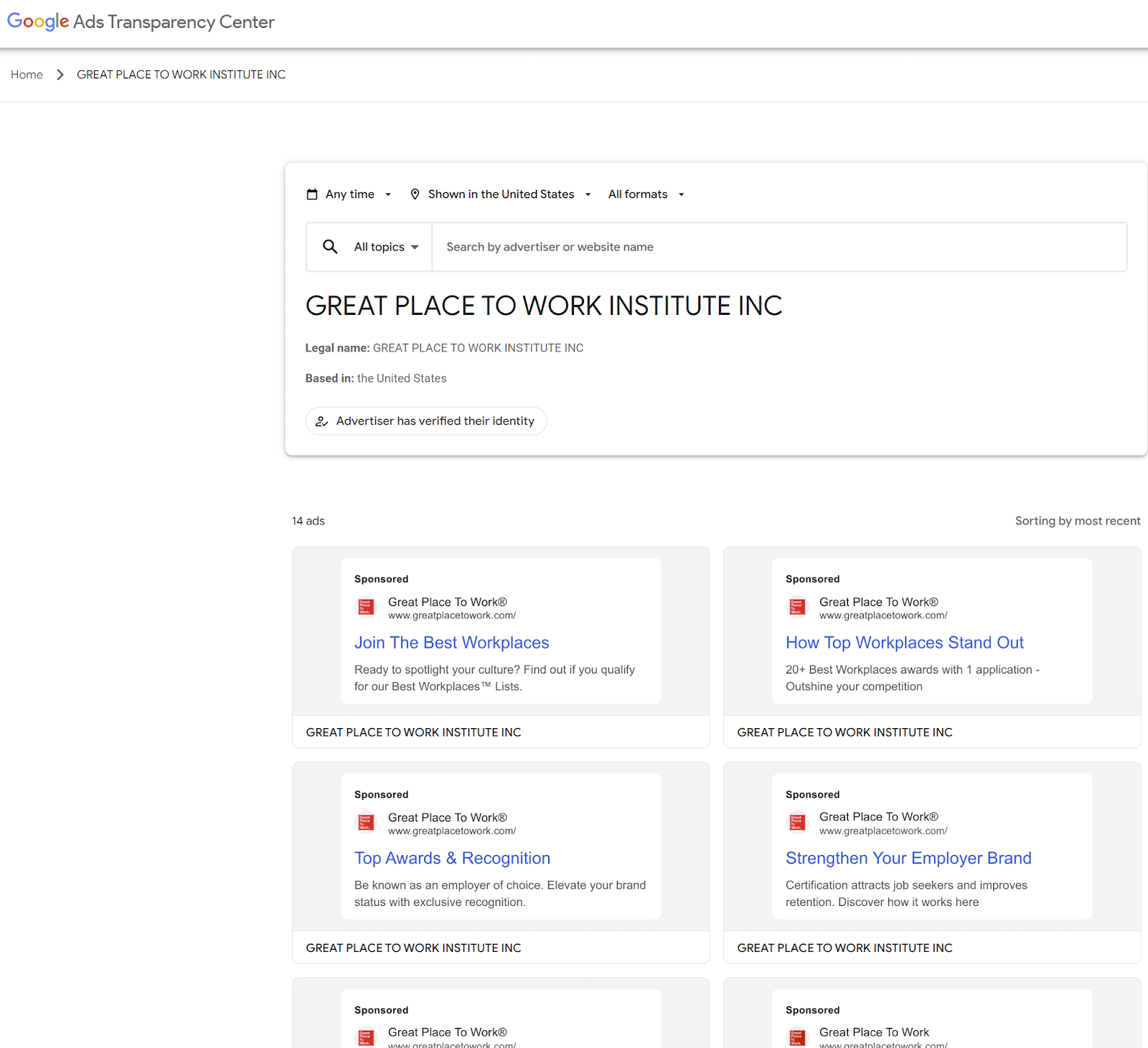

You could stop at Google Ads Transparency Center. But I strongly recommend using other libraries such as:

- Meta Ads library.

- TikTok Ads library.

- Even LinkedIn’s (visit your competitor’s company page, then click Posts > Ads).

At this step, all you want is to populate a table with your competitors and all the different ad networks you can think of. This will give you a good idea of their reach, which strongly correlates with their ad budget.

Ultimately, you don’t want to compare yourself to a behemoth. That data can help show your CEO that, maybe, they should stop comparing your small company’s results to those of much bigger competitors.

Channels and audiences

Once you find a competitor on several ad networks, notice the overall audience they address on that network. Sometimes, there won’t be any difference, but if you’re lucky, you can learn best practices without spending any money.

In the below example, Welcome to the Jungle is a job search engine. Notice how LinkedIn ads are aimed at recruiting companies and YouTube ads are aimed at recruiting job candidates.

If you were to target one or the other audience, that would be quite a best practice to steal!

in France, March 2024. Video ads read: “Choose the company that fits you.”

Ad formats

Next stop: ad formats. Those will provide two very interesting pieces of information: the ad channel and the ad format itself.

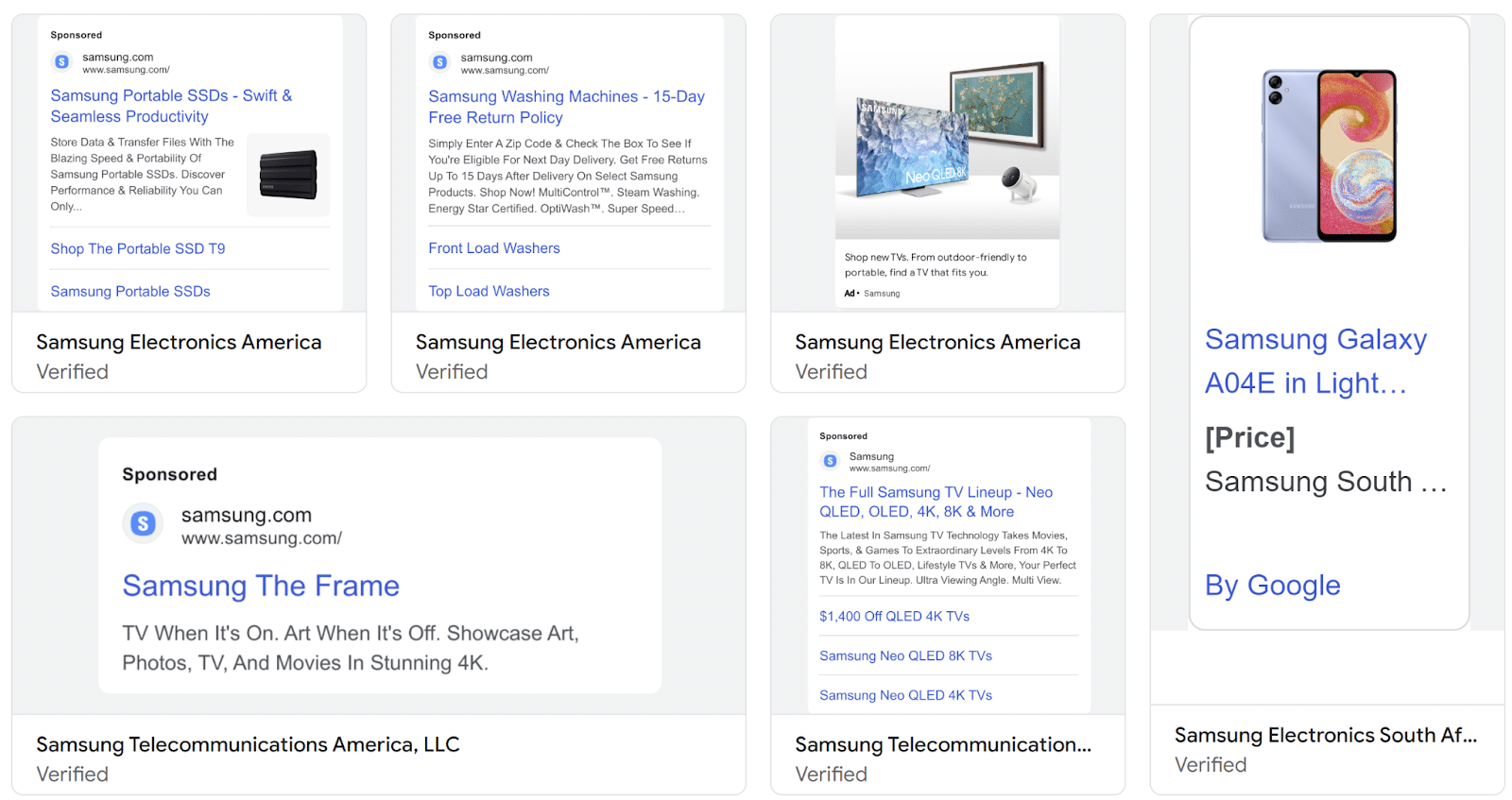

For example, in the screenshot below of Google Ads Transparency Center, you’ll notice Samsung advertises on Search, Display, and Shopping channels.

You can have a rough idea of their budget by looking at those two dimensions (ad channel and ad format). For example, producing video ads is often very costly. In the case of Welcome to the Jungle, there are tons of videos (see screenshot above).

Guess what their media budget looks like?

Comparatively speaking, Google Ads transparency center only shows text ads for Great Place to Work. While it’s not very scientific, it’s safe to say that such an ad format is cheaper to produce – which hints at a lower media budget.

Ad copy and creative

Final ad library stop: You want to note ad copy and creative items that stand out. Those can vary a lot depending on your industry, but here’s a list to get you started:

- Unique selling propositions (USPs): Unique technology, superior service, features, etc.

- Pricing: Discounts, promo codes, sales, etc.

- Emotion: Fear of missing out (FOMO), security, etc.

- Risk-free: Money-back, free trials, warranties, etc.

- Credibility/authority: Testimonials, user reviews, expert endorsements, awards, certifications, etc.

- Urgency/scarcity: Limited-time offers, stock, countdown timers, etc.

- Brand voice: Tone, style, personality, etc.

Again, you can use ad libraries to identify top-recurring copy and creative, which likely indicate top-performing assets.

And if they test several themes, it’s a good idea to look at those ad libraries regularly. Themes that disappear are most probably low performers. You then have two options:

- If you feel you’re a better match for that claim, then experiment with it.

- If you feel you’re not better equipped to answer that need, then discard it altogether.

In the below examples, it’s interesting to note that Suunto makes a powerful claim by linking superior battery life to pioneering since 1936. This builds authority and makes Garmin’s ad copy look bland.

3. Competitor customer journey analysis

Landing page types

Using Meta Ads library, you can click through to your competitors’ landing pages, using the ad’s call-to-action, as if you were on Facebook or Instagram.

For example, the below ad redirects to this landing page, which is most probably optimal: that’s the exact product page that matches the ad creative.

Conversely, the below ad redirects to a collection page. Is that best practice? Does it depend on product families?

Categorizing competitor landing pages by type (home, collection, product, etc.), you can answer those questions easily.

Landing page experience

Below are some items to note:

- Pop-ups: In the above Banana Republic example, we have not one but two pricing-related messages. Clearly, they’re discounting hard. Should you match that?

- Format: In the above Banana Republic example, the landing page is clearly a mobile-first page. Which is not the case for Salomon. Who do you think gets higher conversion rates?

- Load time: Look into PageSpeed Insights, which will provide reliable comparison metrics with your own page:

Funnel analysis

If you can, go to the end of the purchase experience (this is tougher for B2B competitors, but more often than not, you can sign up for a demo, free trial, etc., which is already very interesting).

What you want to pay special attention to are:

- Callouts: In the example below, they use FOMO and free shipping items. Notice how that ties in with the ad theme and landing page pop-ups.

- Cross-sell/upsell: Are they showcasing specific products? And could you use that to your own advantage? For example, can you bundle your products in a way that outsmarts competitors?

Landing page content analysis

On top of the above, I strongly recommend analyzing the overall content. While you could theoretically use SEO tools such as Ahrefs or Semrush, I often found that real-life ad landing pages aren’t indexed by them. It’s likely because those pages change too often and have relatively low SEO impact.

This means you need to revert to manual analysis. To do so, you can simply scan the page and identify your competitor’s unique value proposition. You should identify their market positioning (and how you can optimize your own to be distinct and appealing).

While it’s all fine and dandy to do so for a few landing pages, if you need to do that at scale or at least a dozen competitors, it quickly becomes cumbersome. If that’s the case, then I’d suggest extracting the landing page words using some sort of scraping technique.

An easy way to do so is to use the relatively new Excel’s Power Query web connector. If you’re not familiar with this, I strongly recommend Leila Gharani’s video, which does an excellent job of outlining what it is and how to use it.

Once that’s done, you can use Excel to identify top recurring keywords. If you’re unfamiliar with such techniques, you can simply use ChatGPT to come up with the right VBA.

Dig deeper: 5 tips for creating a high-converting PPC landing page

Further analysis

Looking outside of PPC landing pages will help provide additional insights you could leverage in your own campaigns. Here are some pieces of advice to go the extra mile:

- Sign up for your competitors’ newsletters and other email/loyalty programs to identify recurring themes, their sequence and frequency, etc.

- Visit their social media accounts and note their latest content theme, posting frequency, engagement levels and how they integrate with their PPC ads.

- Use Ahrefs or Semrush to analyze overall backlinks and organic results and note how they correlate with the above ad and landing page content analysis.

- Visit customer review sites (Maps, Yelp, etc.) to understand their strengths and weaknesses and leverage them in your own content.

At this point, you should be able to pinpoint your competitors’ top vocabulary, which strongly indicates what audience (and keywords) they target.

4. About competitor budget and industry benchmarks

About competitor budget

Information about your competitors’ paid media budget is proprietary to Google Ads, Meta Ads, etc., so no tool can provide reliable details about it.

And sure, you can estimate competitor budgets with the above items (ad networks, Auction Insights report, channels, ad volumes, landing pages, etc.). Still, I recommend not going too crazy on this.

Why? Because, in the end, it doesn’t matter much.

I once worked with a client in the mattress sector who spent millions every month. Recently, my agency started working with a much smaller mattress company. Do their PPC campaigns relate? Sure, to an extent, they do.

But at their core, they cater to very different demographics. And their core PPC KPIs and goals are vastly different.

Don’t get me wrong, we benchmarked much bigger mattress competitors. But we mainly came out with recommendations/insights that fitted with a smaller company.

And their budget wasn’t part of those insights because it did not matter.

Comparing yourself to industry benchmarks

Similarly, I won’t even link to industry-level cost per click or conversion rate benchmarks. If you’re really interested in those, you can easily find them on Google. Personally, I believe they’re misleading at best.

Even broken down by industry, they don’t paint an accurate picture. Worse, they can stir you in a direction you don’t want to take.

Think about it for a second: a conversion rate benchmark doesn’t mean anything if you don’t know what the conversion actually is. Are we talking about a sale? A lead? A quality visit? We don’t know. So, do you want to obsess over conversion rate? Perhaps there’s more pressing items to tackle.

Same for cost per lead types of benchmarks: what lead are we talking about? A simple email form? An MQL? An opportunity? Again, PPC benchmarks never have such granularity, so they don’t make sense.

Same for CPCs, CTRs, etc. You can have great CTRs (and low CPCs) by offering crazy discounts. But does it make your ad relevant from a business perspective? Perhaps not.

Benchmarking PPC competitors

Benchmarking PPC competitors involves comparing macro observable trends (channels, ad themes, customer journeys, etc.) among multiple competitors.

Your goals should be to identify best practices and identify blue oceans, not spend time pulling hairs over CPCs.

If you do that exercise regularly, you will be on a great path to outsmart your competitors and save budget. Have fun!

from Search Engine Land https://ift.tt/GArRly5

via IFTTT

No comments:

Post a Comment